Correspondence including monthly billing statements are available through your online account. If you have not created an account yet or have opted out of receiving electronic correspondence, you will receive them by mail. If you would like to learn more about managing your student loan online and how to create an online account, click here.

If you are having difficulty making your payments or have questions, contact us. We are here to help review the options available.

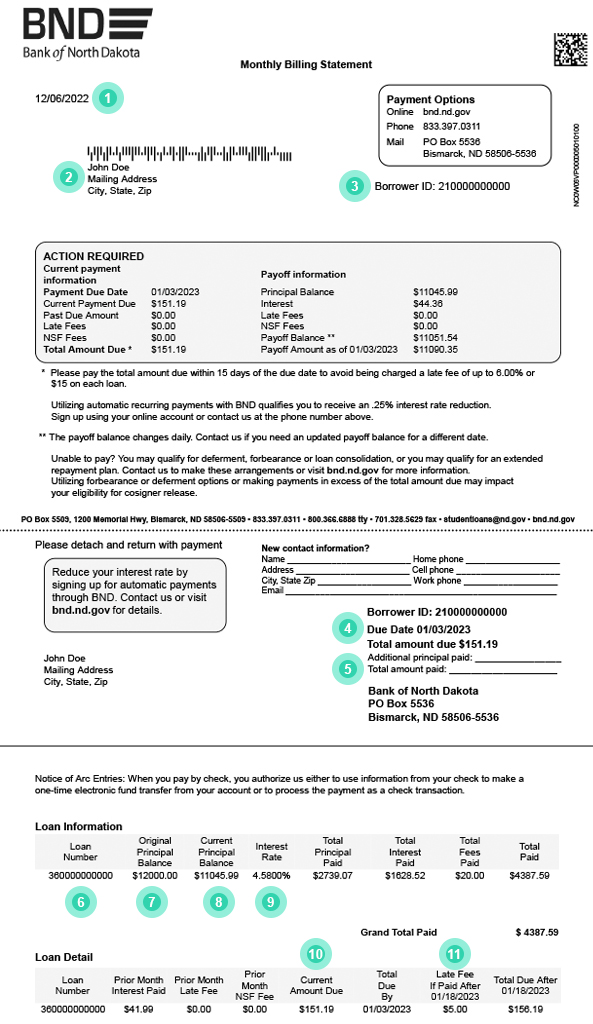

Monthly Billing Statement

Your monthly billing statement is sent typically 25 days prior to your payment due date. Your statement will provide you with your payment due date and payment amount due as of the day it is printed.

- This is current information as of this date.

- We must have your up-to-date information on file. You may update your contact information by phone or online. You may also “opt-in” for paperless billing by logging in to your online account.

- This 12-digit reference number helps identify your account.

- If your total due is not paid within 30 days of your due date, the delinquency will be reported to the consumer reporting agencies. If you have a cosigner on the loan, the cosigner will also be reported as delinquent.

- If you are paying more than your monthly payment, the extra may be applied to the principal balance. To have it applied to a specific loan, please list the loan number and the amount on the “additional principal paid” line.

- You may have more than one account with different loans under each account. In this example, the loan number starts with “36.”

- The original principal balance is the original disbursement amount and does not include any interest that may have been capitalized.

- Your current principal balance = Your original principal balance + capitalized interest – principal paid.

- Reduce your interest rates by 0.25% when you sign up for ACH while in repayment status!

- Each loan has a monthly payment amount; however, your monthly billing statement provides a sum of these amounts, so you only need to remit one payment per statement.

- If your monthly payment is not received within 15 days of your due date, this shows you the amount of late fees you will be assessed.

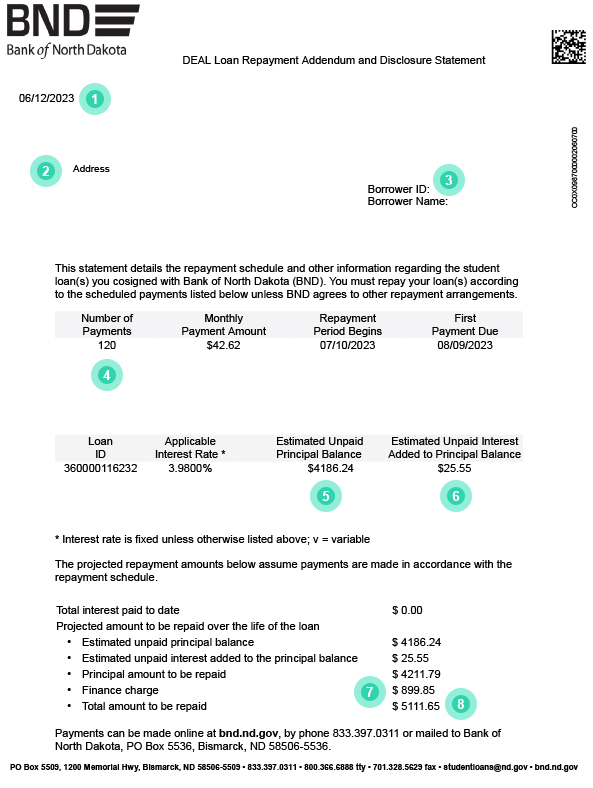

Loan Repayment Addendum and Disclosure Statement, a.k.a. Grace Notification

Your loan repayment addendum and disclosure statement, also known as your grace notification, is the first statement you will receive. It is sent typically 45 days prior to your loan entering repayment. Your statement will provide you with your first payment due date, the date your repayment begins, your monthly payment amount, number of payments, interest rate, estimated unpaid interest balance that may be added to your principal balance, and more.

- This is current information as of this date.

- We must have your up-to-date information on file. You may update your contact information by phone or online. You may also “opt-in” for paperless billing by logging in to your online account.

- This 12-digit reference number helps identify your account.

- The number of payments is also referred to as the term of the loan. The standard repayment term is 10 years or 120 months. If you have a total student loan balance of $30,000 or more, your payment term may be extended up to 25 years upon request. Contact us for more information.

- The estimated unpaid principal balance reflects your original loan balance minus any principal payments you may have made since the loan was disbursed.

- Your student loan started accruing interest as soon as the loan funds were disbursed to the school. This is the estimated amount of interest that has accrued and is unpaid. Any balance that remains unpaid at the end of a deferment is added to the principal balance of the loan. If you’re able to make any payments toward the accrued interest, we recommend you do so prior to the last day of your grace period.

- The finance charge is the total amount of interest and fees that are anticipated based on the current repayment term and balances.

- If you repaid your loan based on the terms and conditions outlined in this document, this would be the total amount to be repaid over the life of the loan. You may be able to reduce this amount by making more frequent or larger payments than reflected. Contact us for information.

Call Us

(833) 397-0311

Email Us

studentloans@nd.gov

Start A Live Chat

When active, connect by using the icon in the lower right corner to connect.

An official website of the State of North Dakota

An official website of the State of North Dakota