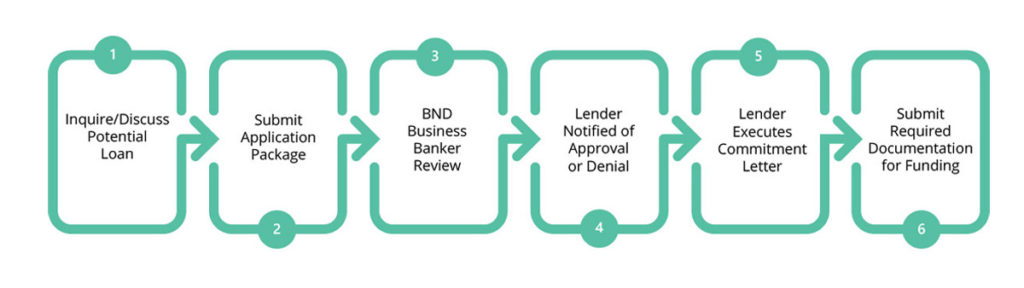

New Loan Request or Renewal Process

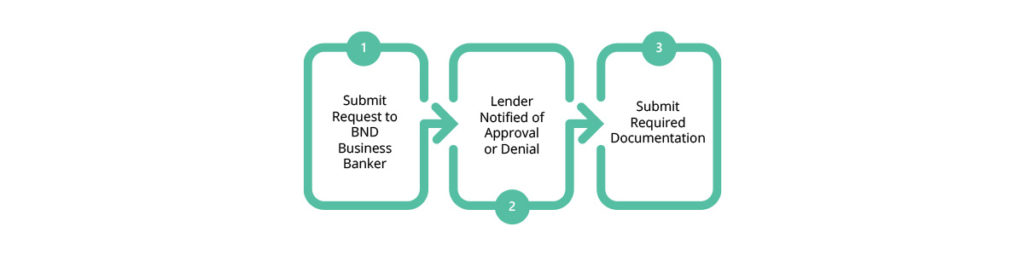

Loan Modifications or Change in Terms Process

Pre-Loan Funding

For loan documentation prior to loan funding. This includes the commitment letter, the note and all documents listed on the ‘Prior to Funding Checklist’ sent with the commitment letter.

Post-Loan Funding

For follow-up documentation after funding. This includes on-going financial information, documents recorded after loan closing and hazard insurance tracking.

Payments or Payoffs

For payments, payoffs, and advances on loans that have been funded. BEG Loan Payment Histories are also sent to the same email for processing with Bank of North Dakota.

Please call 701.328.5795 or email us at bndloanfunding@nd.gov with any questions.

An official website of the State of North Dakota

An official website of the State of North Dakota