In 1836, the U.S. Congress did not renew the charter for the Second Bank of the United States, opening the door for states to start their own banks. Alabama, Kentucky, Illinois, Vermont, Georgia, Tennessee and South Carolina all created banks that were completely owned by the state government. Missouri, Indiana and Virginia had banks with the State holding a majority interest and a number of other states created banks with the State owning a minority interest. By 1900, only Virginia and Kentucky survived. Today, these two banks are no longer functioning.

During the early 1900s, agriculture, specifically wheat, drove North Dakota’s economy. Frequent drought and harsh winters didn’t make it easy to earn a living. Grain dealers outside the state who suppressed grain prices, farm suppliers who increased their prices, and banks in Minneapolis and Chicago which raised the interest rates on farm loans—sometimes up to 12%, further complicated the arduous growing season.

These conditions frustrated North Dakotans, and attempts to legislate fairer business practices failed. A.C. Townley, a politician whom the Socialist Party fired, organized the Nonpartisan League with the intent of creating a farm organization that protected the social and economic position of the farmer.

The Nonpartisan League gained control of the governor’s office and the Legislature in 1918. Their platform included state ownership and control of marketing and credit agencies. In 1919, the state Legislature established Bank of North Dakota (BND) and the North Dakota Mill and Elevator Association. BND opened July 28, 1919, with $2 million of capital.

Several sections of the North Dakota Century Code address the creation of the Bank, its oversight and role in the state. Today, the North Dakota Legislature will appropriate funds from BND when needed through the budget process or state law.

BND has responded to the state’s needs since inception. For example, when teachers were paid with warrants rather than cash during the Great Depression, BND paid them in full rather than with the 15% loss they would take when trying to cash it elsewhere. In the 1940s, BND sold back farmland which had been foreclosed during the ’30s, usually to the original families who owned it and had been allowed to remain on the land and farm it.

In 1945, BND made its first transfer of funds to the State’s General Fund, $1,725. By the end of the 1950s, most of the farmland purchased from farmers during the Great Depression had been sold, and the Bank was making home mortgage loans in small communities when community banks were not doing so.

Governor William Guy took office in 1961. His belief that the Bank should serve as an engine for economic development highly influenced its course. As a result, the commercial loan portfolio increased significantly by partnering with financial institutions for participation loans. In 1967, BND made the first federally insured student loan in the United States.

In addition to economic development support, BND has provided recovery funding during disasters such as the 1997 floods in Grand Forks, the 2011 floods in Minot and Bismarck and agriculture relief loans during times weather-related hardship.

Today, in partnership with a majority of North Dakota’s financial institutions, BND fulfills its mission to promote the development of agriculture, commerce and industry in North Dakota. The operating policy, established in 1919, stated that the Bank shall be “helpful to and to assist in the development of state and national banks and other financial institutions and public corporations within the state and not, in any manner, to destroy or to be harmful to existing financial institutions.” The Bank’s operating policy continues to serve as a guiding principle for the Bank’s work in our state.

Bank of North Dakota has been in Bismarck since it opened in 1919, moving to its current location in 2008. While there are no branches of the bank, offices with lending officer staff members are in Fargo, Grand Forks and Minot.

Organizational Structure

Industrial Commission

The 1919 State Legislature created the State Industrial Commission whose function was to conduct and manage, on behalf of the State of North Dakota, certain utilities, industries, enterprises and business projects. The Industrial Commission was charged with the operation, management and control of BND. The Governor who acts as Chairman, the Attorney General, and the Agriculture Commissioner compose the Commission.

Advisory Board

In 1969, state statute established the BND Advisory Board of Directors. The Governor of North Dakota appoints Advisory Board members knowledgeable in banking and finance to the seven-member board. The Advisory Board reviews the Bank’s operations and makes recommendations to the Industrial Commission concerning management, services, policies and procedures.

Executive Committee

Bank of North Dakota’s Executive Committee consists of ten members:

- President/Chief Executive Officer

- Chief Administrative Officer

- Chief Talent Officer

- Chief Public Affairs Officer

- Chief Operations Officer

- Chief Financial Officer

- Chief Banking Officer

- Chief Credit Officer

- Chief Risk Officer

- Chief Innovation Officer

Employees

The Legislature has authorized 173 full-time equivalents for employment at Bank of North Dakota.

Operations Overview

BND is not FDIC Insured

In contrast to most commercial banks, BND is not a member of the Federal Deposit Insurance Corporation (FDIC). North Dakota Century Code 6-09-10 provides that all BND deposits are guaranteed by the full faith and credit of the State of North Dakota.

Minneapolis Federal Reserve Bank

BND has a business relationship with the Minneapolis Federal Reserve Bank. The Bank does check processing, deposits excess cash balances, maintains a reserve requirement, safe keeps all its Fed book entry securities and has discount window borrowing authority.

Bank profits returned to the State

The Bank’s profits are utilized in three ways: appropriation through the North Dakota Legislature to fund the General Fund, mission-driven loan programs and BND’s capital.

The ND Legislature appropriates the transfer of funds to the state’s General Fund. Every legislative session reviews the state’s budget needs and the amounts designated from BND’s capital for the General Fund will vary based upon the needs of the state and BND’s desire to maintain adequate liquidity and capital.

The Bank’s profits are also used to support its mission-driven loan programs. With legislative approval, BND funds interest rate buydowns and off-balance sheet programs that help drive economic development and infrastructure projects across the state.

Lastly, BND’s excess earnings are retained and accumulated to fund capital. The Bank’s target is to maintain a Tier One capital level of 12%.

Deposit base

All state funds must be deposited with BND unless specific authority allows for outside investments. Most of BND’s deposits come from the state’s collection of taxes and fees. The balance of the Bank’s deposits come from corporate accounts, North Dakota city and county government entities, and North Dakota financial institutions. North Dakota residents are a very small part of our deposit base.

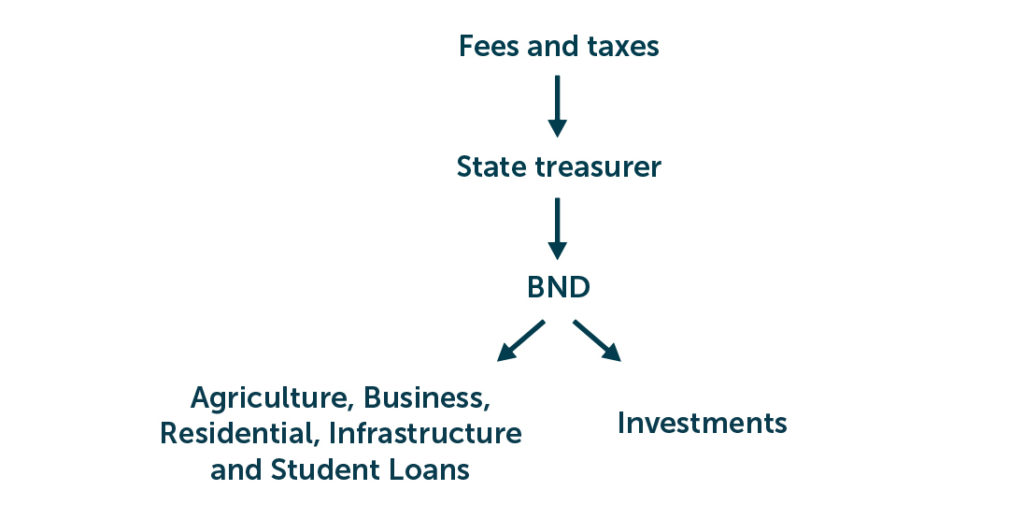

This graphic demonstrates how fees and taxes are received by BND and distributed to North Dakota residents.

Investment strategy

BND follows a conservative investment policy, investing in AAA securities backed by the federal government or agencies of the federal government.

Need for reserves

Bank of North Dakota maintains adequate reserves and allowance for credit loss to protect itself from credit risk embedded in its loan portfolio. It utilizes a model that considers specific risks and economic factors to ensure adequate allowance levels.

Audit guidelines

The North Dakota Department of Financial Institutions provides audit oversight to Bank of North Dakota, but has no regulatory authority over BND. In addition to its audit activities, BND has a robust internal audit department to ensure compliance with federal banking regulations and employs an aggressive external audit schedule as well.

Partnership with local financial institutions

Bank of North Dakota maintains strong relationships with financial institutions in the state and does not compete with them. This was established in the Bank’s founding principles in 1919: “BND is to be helpful to and assist in the development of … financial institutions and public corporations within the state and not, in any manner, to destroy or to be harmful to existing financial institutions.”

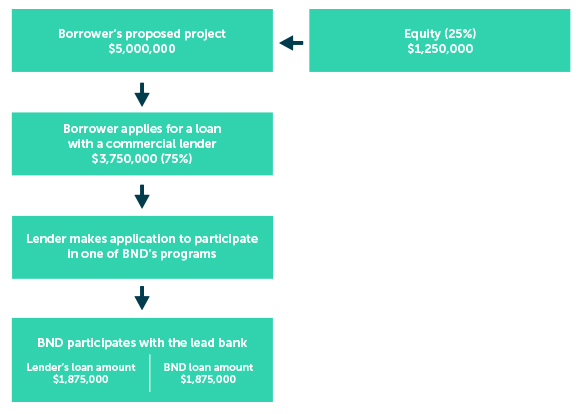

Although individuals receive student loans directly from BND, they are not targeted for other loans or retail accounts. BND does not offer credit cards or own ATM machines for the general public. Individuals and businesses must work with their local financial institution for business and most agriculture loans. If the local bank or credit union wants to participate on a loan with BND or the borrower wants to access a BND program, the lead financial institution makes the request, not the borrower.

BND is authorized to assist other financial institutions in providing financing to stimulate economic development in the state. This efficient business model allows it to promote the state’s programs and work with knowledgeable people who understand the communities they serve.

This graphic demonstrates a typical loan transaction for a business loan.

Looking to the future

BND proactively addresses the state’s needs by meeting regularly with our financial institution, government, higher education and economic development partners. Our vision statement, ‘BND is an agile partner that creates financial solutions for current and emerging economic needs,’ continues to drive us to meet our mission ‘To deliver quality, sound financial services that promote agriculture, commerce and industry in North Dakota.’ This mission statement was established in 1919 and remains the same today, reminding us of our important role and responsibility to the citizens of North Dakota.

Learn more about the history of Bank of North Dakota at TheBNDStory.nd.gov.

An official website of the State of North Dakota

An official website of the State of North Dakota